Successfully implementing business strategies is a challenge across all industries. Nevertheless, insurance companies have shown a higher susceptibility to failures compared to other industries. According to our research, only 37% of larger projects within the insurance industry can be deemed successful. So, why is the success rate so low? Boutique consultancy TTE Strategy has partnered with trueLedger, the smart contracting platform for professional services, to analyse the factors contributing to success and the stumbling blocks faced by critical projects. Together, we have identified six root causes for failure and devised pragmatic actions to mitigate them, ensuring the successful delivery of projects and the return on their investments.

Currently, the majority of Swiss insurance firms are undertaking significant efforts to enhance their operational and digital capabilities. These initiatives often encompass projects with investments ranging from CHF 20 million to multi-year programs costing up to CHF 300 million. They all promise to rejuvenate the technology stack, reduce operational costs, and, most importantly, offer an exciting new customer experience. We deem these initiatives successful when they deliver their full business value while adhering (within 5%) to the initially agreed-upon budget and timeline.

The insurance industry faces unique challenges that contribute to lower program success rates compared to other sectors. Insurance products are inherently complex, requiring additional customization to accommodate various distribution channels. Furthermore, the industry is subject to stringent regulatory obligations and the demand for data and insights to maintain a profitable portfolio is among the highest in any sector.

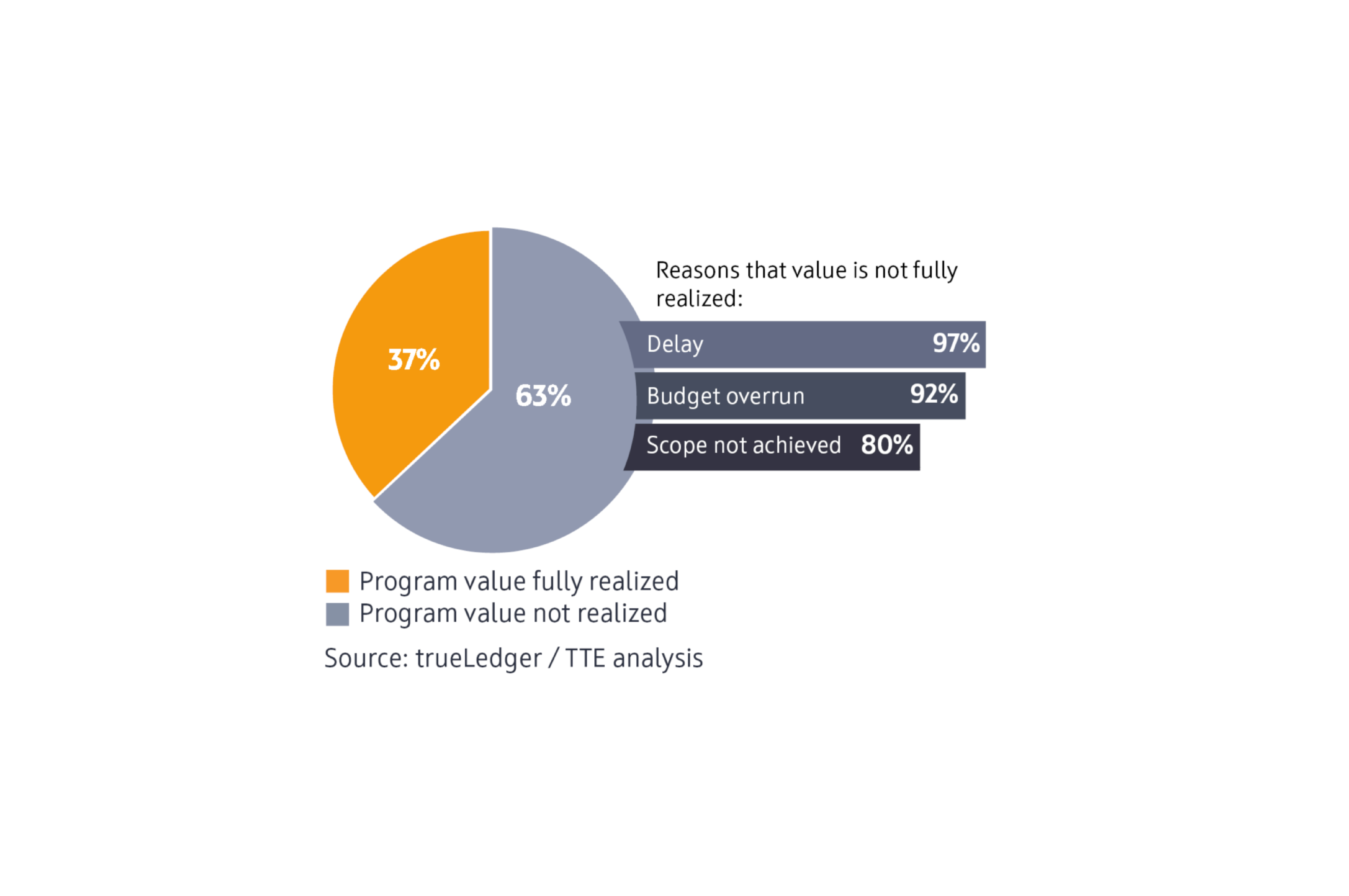

In this challenging environment, 63% of programs do not achieve success according to our data. Among the most prevalent causes of failure, such as unforeseen cost escalations or program extensions, our dataset reveals that over 80% of unsuccessful programs also fail to deliver the complete scope and business value, which is considerably more detrimental. The expected recurring benefits that justified the initial investment never fully materialize. Additionally, our research reveals an interesting trend: As the size, duration, and scope of programs increase, the likelihood of failure also rises. Success is much more attainable when programs are kept manageable in terms of size, duration, and scope.

Chart 1: Most projects fail to deliver the full value on time and on budget

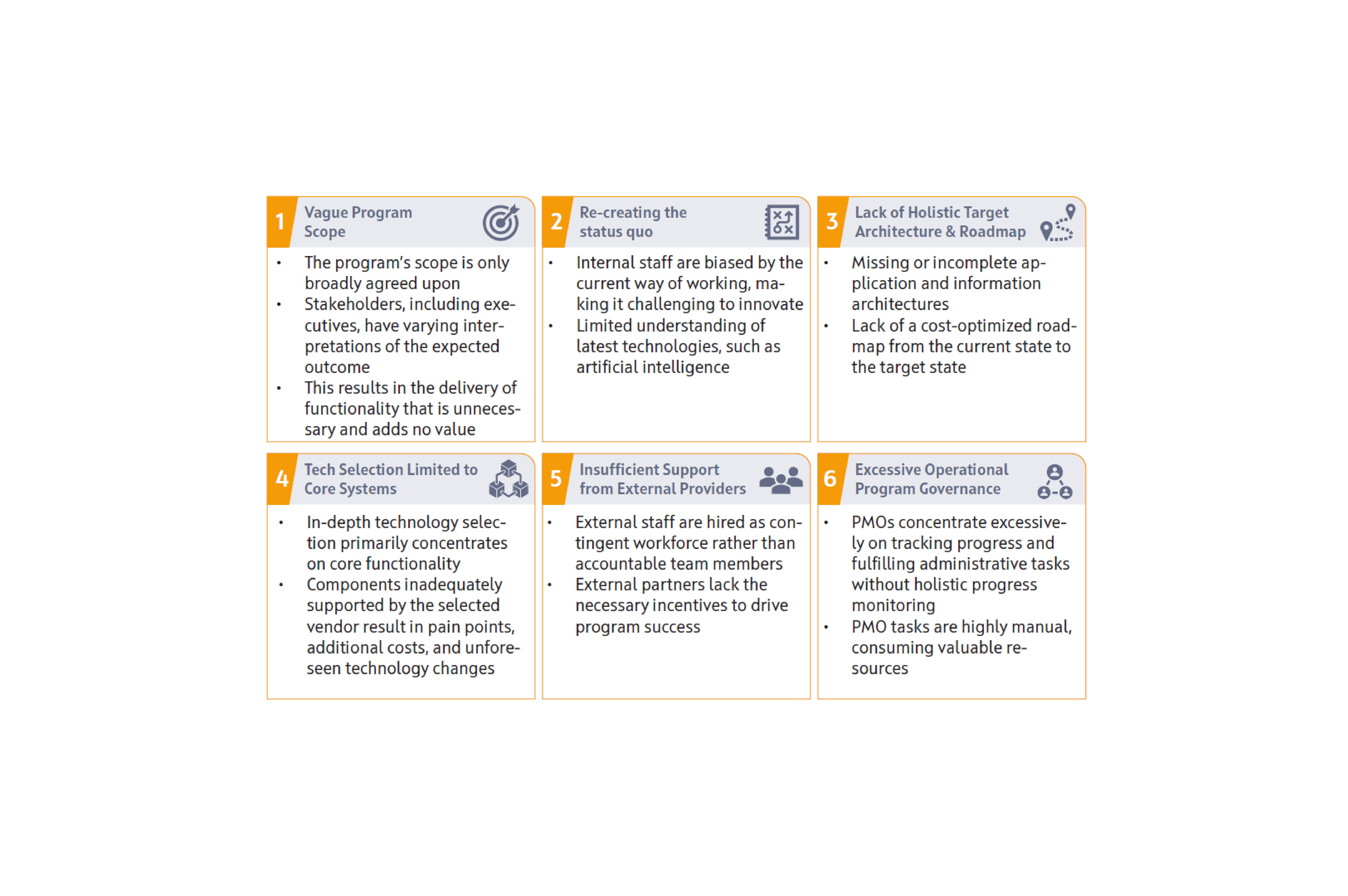

In addition to recognizing the inherent complexities within the insurance industry, insurers can take proactive steps to enhance the success rates of their programs. We have identified six root causes of failure that require active attention and navigation:

1. Vague Program Scope:

When establishing a substantial transformation program, it is crucial to ensure clear mutual agreement on the scope throughout the organization. Surprisingly, we have witnessed numerous instances where programs operated with a broadly agreed-upon scope, yet stakeholders, including executive committee members, held differing understandings about the expected outcomes. The result: Delivered functionality came as a surprise, perceived as unnecessary and non-value-adding.

2. Re-creating the Status Quo:

Incorporating those who run the current business into the transformation process generates high organizational buy-in. However, for many insurers, this approach carries risks. Teams rooted in the status quo may struggle to think outside the box and envision how the latest technologies can reshape existing operations. The result: Insurers invest heavily in new technologies but unintentionally re-create their legacy processes.

Chart 2: 6 Root Causes of Program Failure or Significant Delays

3. Lack of Holistic Target Architecture & Roadmap:

Programs must operate with a comprehensive target architecture and an optimal „as-is“ to target roadmap to succeed. Otherwise, gaps, inconsistencies and duplicated functionality become almost inevitable, leading to misaligned information flows. We have observed numerous projects requiring unplanned last-minute investments to address missing functionality, align disparate systems, build complex interfaces, and create temporary components that are eventually discarded.

4. Tech selection limited to Core Systems:

When selecting significant components like core insurance platforms, insurers tend to engage in lengthy evaluation processes to choose the best provider. However, these decisions are often linked to an implicit “full suite” approach, incorrectly assuming that all features of one vendor can be used out of the box. The result: Many insurers spend excessive amounts of money trying to enhance weak features offered by their chosen vendor rather than opting for more cost-effective, nimble alternatives.

5. Insufficient Support from External Providers:

Insurers frequently rely on external providers to strengthen project teams with additional capacity and expertise. These externals are often brought in as contingent workforce with no direct accountability for the program´s outcome. The result: Sizeable groups of external providers may act tactically, concentrating on clocking their hours, rather than going the extra mile to ensure the project‘s success.

6. Program Governance:

Project management capabilities are well established within the insurance industry. However, we have noticed that Project Management Offices (PMOs) often concentrate heavily on manual and administrative tasks, such as generating status reports and checking boxes, rather than ensuring that the boxes are appropriate, consistent, and encompass the entire program scope. The result: Programs appear to be on-track for a long period before they unexpectedly encounter major roadblocks that were not identified earlier.

TTE Strategy and trueLedger have jointly developed an innovative program management framework tailored to address the specific needs and challenges unique to the insurance industry. Building upon traditional project management methodologies, our framework ensures vigilant monitoring of key failure risks while proactively addressing common obstacles. The framework focuses on the following key elements:

1. Visualized Scope:

Making the program scope tangible and visual by employing user stories, linking benefits to this visualized scope, and assigning them to a benefits owner who is committed to their successful delivery.

2. Tangible Guiding Principles:

Before assigning teams to design target processes, operating models, etc., key guiding principles and KPIs are established. These principles ensure the inclusion of innovative approaches and the latest technologies. Independent reviewers serve as quality gates and challengers.

3. Comprehensive Architecture and Roadmap:

Developing comprehensive “as-is” and “target” application landscapes that encompass the entire omni-channel insurance capability map. This approach enables easy identification of functionality gaps, overlaps and areas where current technology choices are incomplete or suboptimal. Maintaining this map throughout the entire transformation journey, including phased iteration steps, serves as an alignment tool and guiding light for all ongoing programs and projects.

4. High Engagement and Accountability of External Providers:

Just like internal employees whose performance and bonuses depend on the project´s success, all contributing external providers are contracted in a manner that links their compensation to the overall success of the program. The appropriate commercial structure should be selected based on roles and responsibilities to ensure alignment.

5. Smart Contracting and PMO Governance Automation:

Through the selection of tactical collaboration tools, a PMO operating framework is established that automates governance and administrative tasks. This framework provides real-time transparency and frees up bandwidth to focus on insights and rapid decision-making.

TTE, in collaboration with trueLedger, offers project and program reviews tailored to assist insurance companies in assessing their specific project risks and devising strategies for successful mitigation. Contact us to significantly increase your project success rate in as little as two to six weeks.

TTE Strategy